Savings – and costs – for a 15-year mortgage

The biggest advantage of choosing a 15-year loan is lower interest costs.

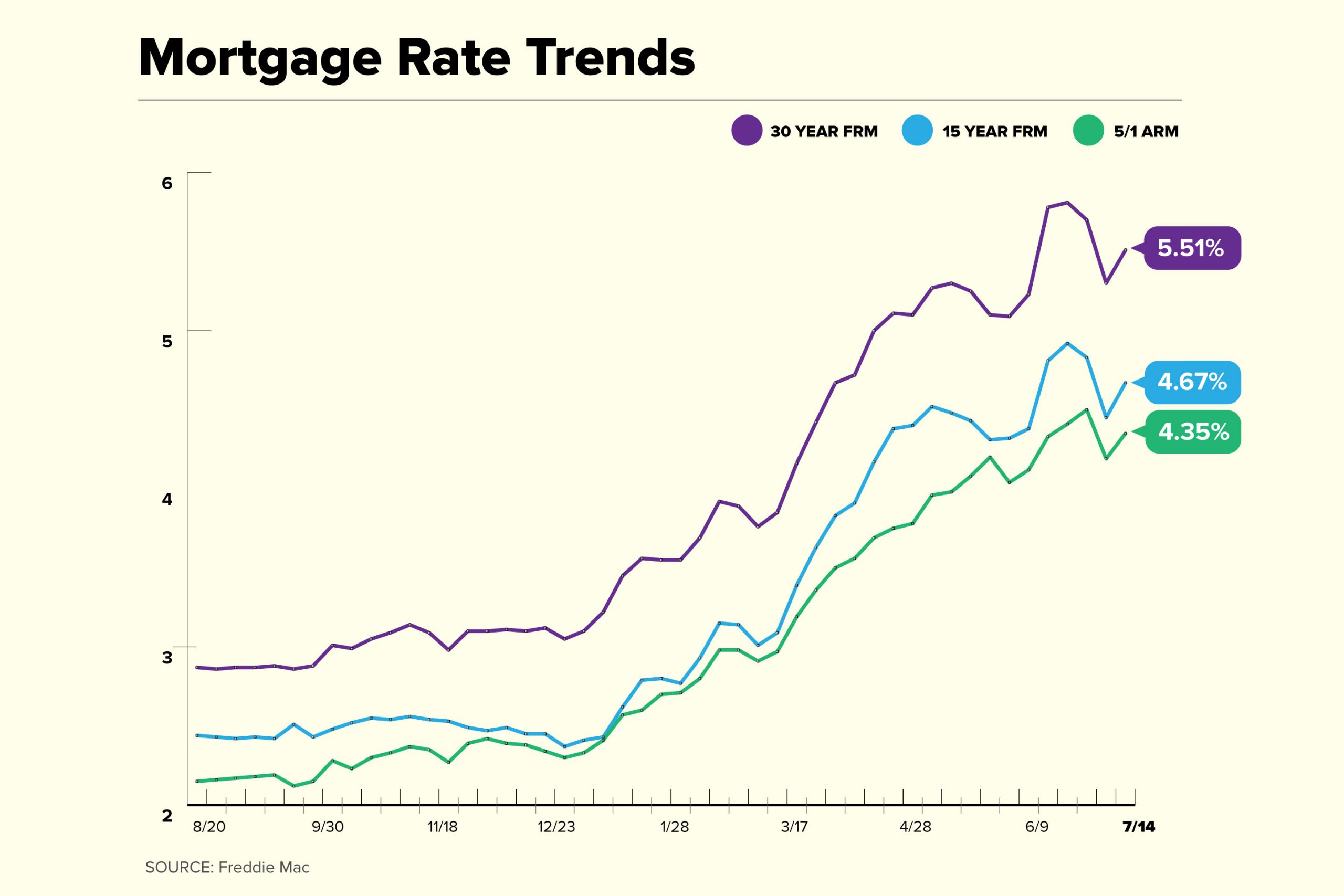

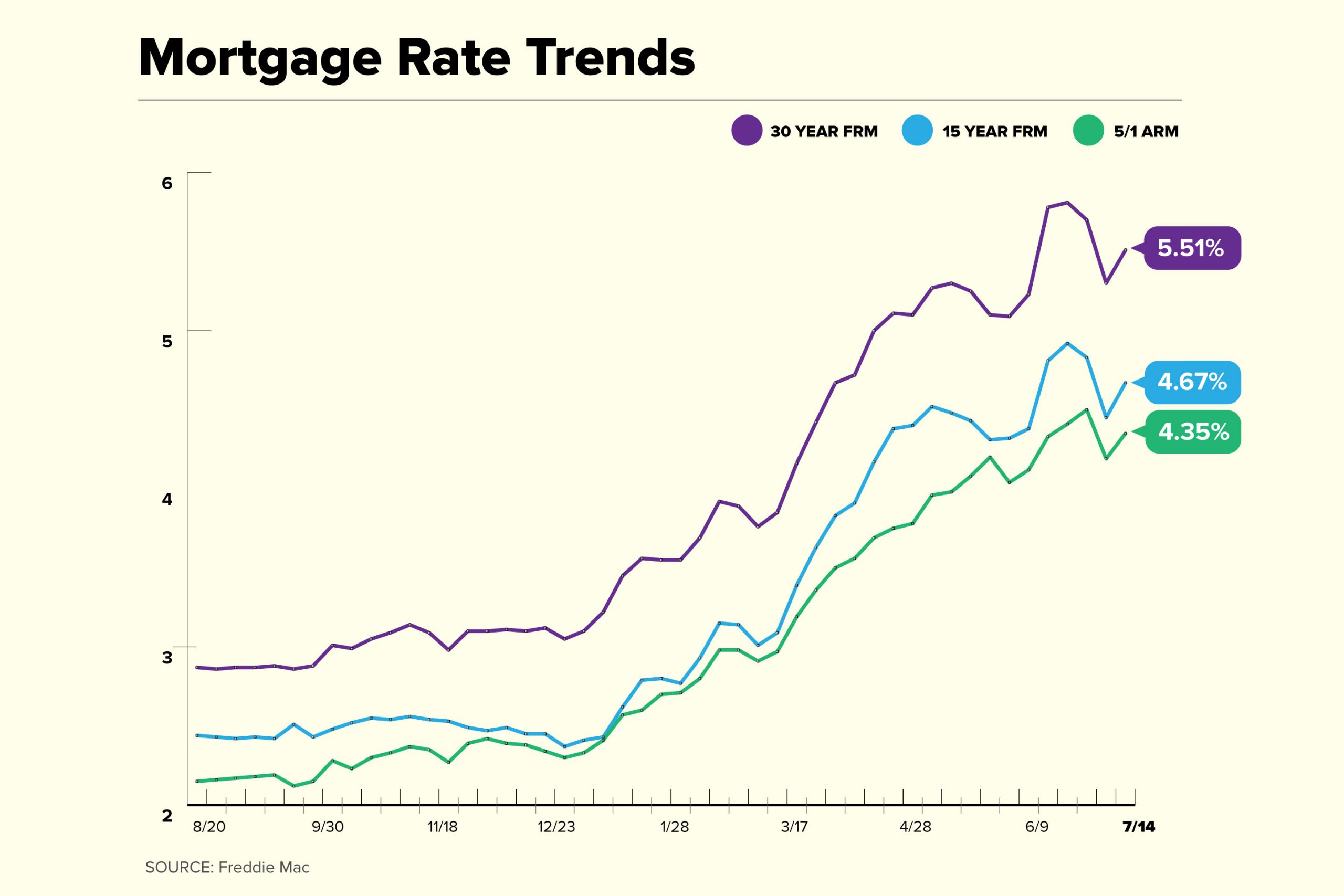

The reason for this is twofold: First, you pay interest for fewer years. Furthermore, 15-year loans have always offered lower rates than long-term mortgages. According to Freddie Mac, the average interest rate for 15 years was 3.39% in 2019 and 2.61% in 2020. On 30-year loans, it was 3.94% and 3.11%, respectively.

Why are short-term interest rates so much lower? According to Glenn Bronker, president of mortgage lender Ally Home, “Lenders view these short-term loans as less risky investments.” And in the mortgage world, the lower the risk of the lender, the better the interest rate.

Low rates are not the only advantage of 15-year loans. Short-term loans also allow homeowners to get rid of their mortgage debt faster. This can mean an early retirement, a more robust savings, or an investment strategy for later.

“Many Americans are forced to continue doing well into their later years because of the need to make mortgage payments,” said Eli Sklar, senior loan advisor at LoanDepot, a senior loan advisor at LoanDepot .

“People feel and realize that they want to retire earlier in life and paying off the mortgage more quickly and at a lower rate will effectively allow that.”

These loans are not without fault, of course. First, choosing a short-term loan often means higher monthly payments. On the same $200,000 loan referenced earlier, a 15-year term will come with a monthly payment of $1,306.

30 years? That would be only $818 – a difference of about $500.

Jeff Taylor, co-founder, said: “The biggest drawback to a 15- to 30-year mortgage — for beginning homebuyers and those looking to refinance — is that monthly payments will be higher even with mortgage rates at or near record lows.

” From mortgage technology provider Digital Risk. “This eats into disposable income.”

There is also the issue of qualifying for a 15-year loan. Because of their higher risk – not to mention the high monthly payments they come in – lenders tend to be stricter with 15-year borrowers.

According to Brunker, borrowers will need to meet “tougher financial criteria” than they would need for a 30-year loan. This could mean the need for more income, a lower debt-to-income ratio or a higher credit score.

Data from ICE Mortgage Technology shows that 15-year borrowers tend to have about 20 points higher credit scores than 30-year borrowers.

In December 2020, the average score was 767.6 for people with 15-year mortgages and 747.1 for 30-year borrowers.

15 year mortgage refinance

In general, 15-year loans tend to be more popular with refinancers than buyers. In most cases, homeowners have already paid a large portion of their mortgage. This lower balance means more manageable

payments—especially if the new loan has a lower interest rate than the existing one.

Refinancing is also familiar with mortgage payments. If they’ve been at home long enough, inflation or income gains may make their old payments manageable. So those high costs? It’s

probably not as scary as it is for a buyer—especially when a first-timer is making the jump from a small monthly rent to a much larger mortgage bill.

“When people take out a mortgage to buy a home, there’s usually more monthly housing payments than the buyers used to pay,” Sklar said. “To reduce the jump in monthly payments, they chose to take the option with the lowest payments – a 30-year fixed loan.”

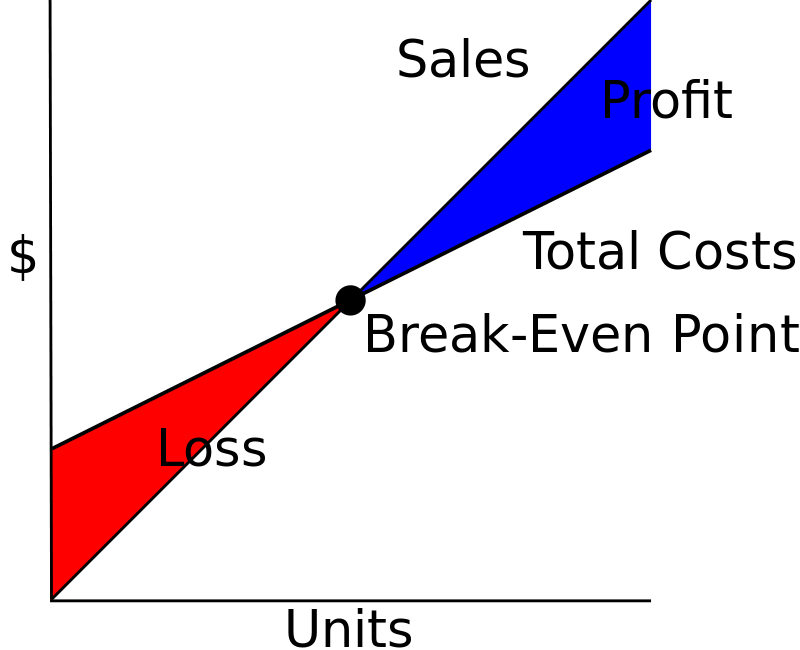

What is your breakeven point?

However, this does not mean that buyers cannot use a 15-year loan if they want to. It also does not mean that every refinance agent should take out a short-term loan. It all boils down to mathematics.

If you are looking to take out a 15-year loan, you will first need to look at the monthly payments. Is it achievable given your income, budget and other expenses? Be sure to include additional costs

that often add to your monthly mortgage payments — things like property taxes, home insurance premiums, and mortgage insurance. These will eat into your cash flow too.

“Deciding between 15 and 30 is really about being comfortable with the repayment,” said Melissa Cohn, executive mortgage banker at William Raveis Mortgage.

Adding, “In today’s crazy world, some might find it safer to get a lower 30-year down payment in case they face any difficulties in the future, while others would welcome the opportunity to pay off the loan faster.”

The interest rate should also play a role in your decision. Use the mortgage calculator to calculate the total interest costs of a 15-year loan and a 30-year loan based on current mortgage rates. Understanding how much each mortgage will cost you over time can help you make the best decision about your money.

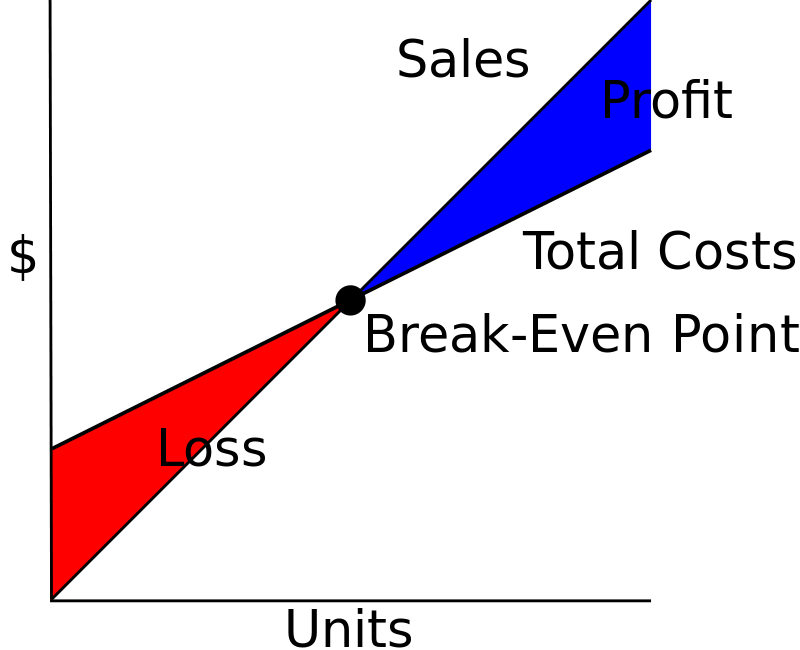

Finally, if you’re refinancing your loan, you should also consider the break-even point – or the point at which you save more than you spent on the reference. Krueger, for example, paid $1,300 in closing costs. Given the interest savings of $268 per month, it will equalize in less than five months.

To determine your break-even point, start with your closing costs and work backwards (refinance closing costs usually come in at about 2% to 5% of the loan amount, if you don’t have a set number to work with). Divide these costs by your monthly interest savings. How many months will it take to get the money back? If you’re planning on staying home for a long time, it’s probably a safe bet going forward.

Keep in mind: You’ll typically get a 15-year loan faster than a 30-year loan, simply because of the added interest savings. It’s just another reason why a short-term loan is a smart choice.

Other options for quick mortgage returns

If you are hoping to pay off your loan faster or save in interest, a 15-year loan is not your only option. Many professionals say there is another option: just make additional payments on a 30-year loan instead.

“Paying extra on a 30-year mortgage enables a homeowner to pay off the equivalent of a 15-year mortgage, but enjoy the safety and convenience of a lower monthly payment should they face an emergency or unforeseen expense in any given month,” said Rick Seehausen, chief executive officer. Operating at Cherry Creek Mortgage, a mortgage lender headquartered in Greenwood Village, Colo.

Depending on your budget, “paying extra” could mean a number of things: adding more to each monthly payment, making one extra payment each year, or even just putting a windfall into the loan—things like tax refunds and holiday bonuses, for example.

Another option – at least for those refinancing – is to refinance into another 30-year loan, enjoy lower interest rates, and still make the same higher payments as before. Since you are already comfortable with paying, you are not putting any extra pressure on your money.

As Krueger explained, “This will allow them to pay off the loan faster and reduce their interest expense, while maintaining the flexibility to reduce their monthly payments in the event of tight cash flow.”