Life insurance in America, Britain and France

If you start looking for information about life insurance, but quickly come across terms you don’t understand, don’t worry, you’re not alone! Life insurance terminology can certainly be confusing at times. Here are some important life insurance terms and definitions to help you understand life insurance and how it works.

By learning about the terms below, you will be better able to make informed decisions when shopping for life insurance coverage.

glossary of life insurance terms

Accelerated benefit rider of death

With this additional policy, death compensation can be paid before the insured dies if he or she suffers from a qualifying terminal illness.

actuary

An insurance mathematician who calculates rates, reserves, profits, and other statistics.

agent

A licensed representative sells insurance policies in either of two categories:

- The independent agent represents many insurance companies and service customers by researching the market for the most advantageous rate for the most coverage.

- The functional agent represents only one company and sells its policies only.

origins

Insurance company assets refer to “all available property of every kind or possession of an insurance company that can be used to pay its debts.” This can mean bonds, stocks, real estate, debts owed to the company, and even office furniture. The amount of assets a company has is usually a reflection of its financial strength.

Detected age

A method for calculating the insurance age of the applicant. This method uses the actual age of the insured and is sometimes called the age of last birthday or actual age.

Request

The form(s) that the insured is required to complete and submit to the insurance company when requesting life insurance coverage.

Physician Statement (APS)

Information provided by the proposed insured’s physician covering medical history and results of medical examinations. It is used to determine the appropriate underwriting rating for the proposed insured.

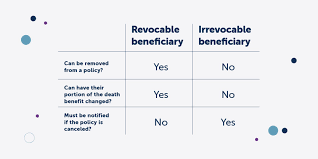

beneficiary

The person or party designated by the life insurance policy holder to receive the policy benefit.

mediator

A licensed representative sells insurance policies. Brokers in the market are looking for their clients and can sell products from multiple insurance companies.

capital

Shareholders’ equity in a stock insurance company. The company’s capital and surplus are measured by the difference between its assets and liabilities. This “pad” protects the interests of company document holders as well as providing a source for dividends to shareholders and investments in new ventures.

The cash value

Some life insurance policies, usually permanent such as whole life, universal life or variable comprehensive life, can pool money into a cash value account. In addition to paying for insurance coverage, a portion of your premium goes into a cash value account that grows tax-deferred over time.

Kids Rider

This optional additional policy provides life insurance coverage for families with children.

Claim

A formal request by the insurance company that the payment of benefits is due under the terms of the divorce insurance policy.

commission

Fee paid to the insurance salesperson as a percentage of the policy premium. The percentage varies greatly by coverage, insurance company, and marketing methods.

potential beneficiary

The party designated to receive life insurance policy proceeds after the death of the insured if the primary beneficiary has died before the insured.

Transferable insurance policy

A life insurance policy that gives the policy holder the right to convert (or replace) the policy into a permanent insurance plan.

coverage

The scope of protection stipulated in the insurance policy. In life insurance, both live and death benefits are listed.

exchangeable

Life insurance coverage for a fixed term that can be converted to permanent insurance regardless of the insured’s physical condition and without a medical examination. An individual cannot be denied coverage or an additional premium on the permanent plan may be charged for any health problems.

Take advantage of the death condition

The amount that the insurance company will pay to the beneficiary in the event of the death of the insured.

Proof of insurance

Proof that the person is an insurable risk.

Nominal amount

The amount the policy is worth. It is related to death benefits because it is the amount that the insurance company will pay to the beneficiary in the event of the death of the insured.

final expenses

End-of-life expenses such as funeral costs, medical bills, or other outstanding debts.

Provide free appearance

Individual life insurance and an annuity that gives the policy owner a specified time, usually 30 days after the policy is delivered, to cancel the policy and refund the full amount of the initial premium paid.

The grace period

The length of time (usually 31 days for term insurance policies) after a premium is due and not paid, during which the policy, including for all riders, remains in effect. If a premium is paid within the grace period, the premium will be deemed to have been paid on time.

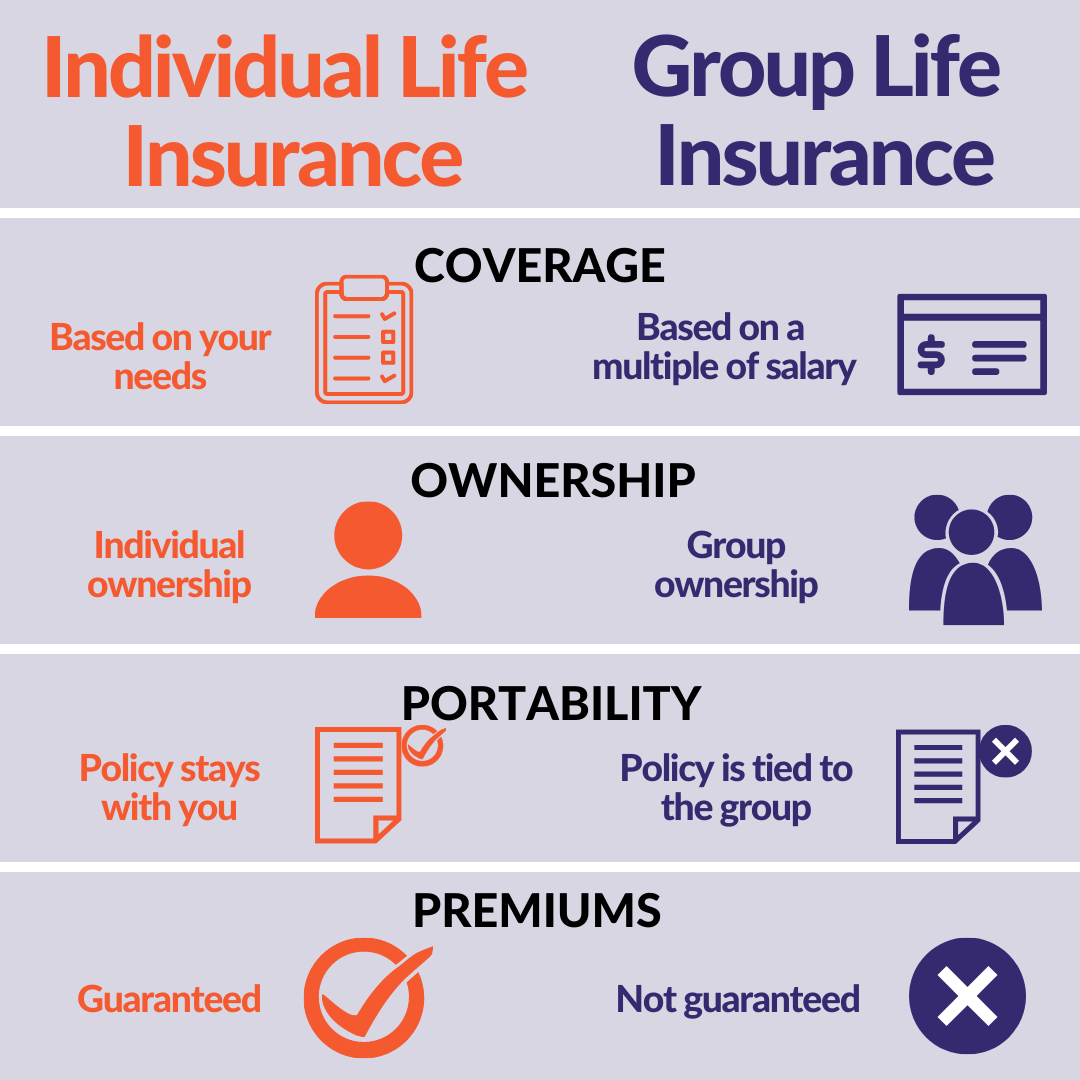

Group life insurance coverage

Insurance products are available to people in a group, usually through an employer.

Guaranteed case

The applicant cannot be refused upon application, even if he is in poor health.

Guaranteed Installments

This means that your premiums won’t go up, unless you change your policy, so you’ll always know how much you’re paying.

non-appeal clause

A life insurance clause that limits the time an insurer is entitled to void the contract on the grounds of a material misrepresentation of the policy request.

insured

The individual covered by the insurance policy.

Irrevocable beneficiary

A beneficiary of a life insurance policy who has a vested interest in the policy continues even during the life of the insured because the policy owner has the right to change the name of the beneficiary only after obtaining the consent of the beneficiary.

Guaranteed benefit

The interest borne by the beneficiary of the insurance policy in the risks being insured. The beneficiary of a life insurance policy has an insurable interest in the insured when the beneficiary is likely to benefit if the insured continues to live and is likely to incur some loss or damage if the insured dies.

slip

Termination of the policy due to non-payment of premium.

life insurance level

Lifetime insurance where the premiums are guaranteed to remain the same for the life of the policy.

life insurance

A contract between an individual and an insurance company in which the insurer agrees to pay an amount of money to a designated beneficiary in the event of the death of the insured.

material distortion

A misrepresentation that would affect the insurance company’s assessment of the proposed insured.

Medical examination

A short assessment to be completed by a medical professional that can be completed at the applicant’s home, workplace, etc. This no-cost test is sometimes required by the insurance company before coverage can be obtained. It is also referred to as a paramedical or paramedical test.

death tables

Graphs showing death rates for a given group of lives at certain ages, drawn from statistics that calculate deaths in a population by age compared to those still alive at that age.

non-smoker / non-smoker

A risk category given to each insurance policy in which the insured is classified as a non-user of tobacco and/or nicotine products.

motivation

The person who pays for the insurance policy.

permanent life insurance

Life insurance that provides coverage for the life of the insured and may also provide cash value.

Policy

The written insurance contract or in which the rights and duties of the insured and the insured are defined.

Anniversary of politics

As a rule, the date on which the coverage under the insurance policy became effective.

excellent

The price of insurance protection for a specific risk for a specified period of time.

The proposed insured

A person applying for life insurance coverage.

quotes

Applicant’s estimated premium amount based on age, gender, coverage amount, etc.

renewal

Automatic re-establishment of divorce status as a result of paying another premium.

Rider

An amendment to an insurance policy that becomes part of the insurance contract and extends or limits the benefits payable under the contract.

risk class

The class of risk, in insurance underwriting, is a group of insured with a similar level of risk. Typical underwriting ratings are preferred, standard and substandard, smoking and non-smokers, male and female. It can also be called rating class or underwriting class.

Section 1035 Exchange

This refers to the part of the Internal Revenue Code that allows owners to replace a life insurance policy or annuity without creating a taxable event.

Section 7702

The part of the Internal Revenue Code that specifies the conditions a life insurance policy must meet to qualify as a life insurance contract, has tax advantages.

Surrender / Surrender Fee

Fees charged to the policyholder when a life insurance policy or annuity is waived for its monetary value. These fees reflect the expenses incurred by the insurance company by putting the policy on its books, and subsequent administrative expenses.

Life Insurance

Life insurance provides protection for a specified period of time. Common document periods are 10, 15, 20 and 30 years. Term policies typically do not create any of the non-forfeiture values associated with permanent life insurance policies.

subscriber

The person trained in assessing risks and determining their ratios and coverages.

underwriting

The process of selecting insurance risks and classifying them according to their degrees of insurability in order to determine the appropriate rates. The process also includes the rejection of those ineligible risks.

Comprehensive life insurance

A life insurance policy that allows for flexibility in premium payments which may affect benefits to be paid and/or duration of time coverage in effect.

Variable life insurance

A form of life insurance whose monetary and / or par value fluctuates depending on the value of the securities or stock products that support the policy, invested in funds called segregated accounts, the sum of which includes the monetary value of the policy.

Comprehensive variable life insurance

A combination of variable life and comprehensive life insurance features under the same contract. Benefits vary based on the value of the underlying separate accounts, and premiums and benefits can be adjusted at the option of the policyholder.

Weaver Premium

Adding a policy that waives the premium of the insurance policy if the insured has been disabled for a period of six months. Once the deficit ends, the premium payments are resumed. What counts as a disability is determined by each insurance company.